All Categories

Featured

Table of Contents

That commonly makes them a more affordable option permanently insurance protection. Some term policies might not keep the costs and death profit the same in time. Increasing term life insurance. You don't want to incorrectly believe you're getting level term insurance coverage and after that have your death advantage modification later. Many individuals obtain life insurance policy coverage to assist financially secure their enjoyed ones in instance of their unanticipated death.

Or you might have the choice to transform your existing term insurance coverage into a permanent policy that lasts the rest of your life. Different life insurance policy plans have prospective benefits and drawbacks, so it is very important to recognize each before you make a decision to acquire a plan. There are a number of advantages of term life insurance policy, making it a preferred selection for protection.

As long as you pay the costs, your recipients will certainly get the fatality benefit if you pass away while covered. That said, it is very important to note that a lot of plans are contestable for 2 years which means protection could be rescinded on fatality, should a misstatement be discovered in the app. Policies that are not contestable frequently have actually a graded fatality advantage.

Understanding the Benefits of Term Life Insurance With Accidental Death Benefit

Costs are normally reduced than whole life plans. You're not locked right into an agreement for the remainder of your life.

And you can not cash out your policy during its term, so you will not receive any kind of financial take advantage of your past protection. As with other kinds of life insurance coverage, the price of a degree term plan relies on your age, coverage needs, employment, lifestyle and health and wellness. Commonly, you'll locate much more economical insurance coverage if you're more youthful, healthier and much less dangerous to guarantee.

Because level term costs stay the exact same for the period of protection, you'll recognize precisely how much you'll pay each time. Degree term insurance coverage also has some adaptability, enabling you to personalize your policy with additional functions.

An Introduction to Term Life Insurance Level Term

You may have to meet details conditions and qualifications for your insurance provider to pass this rider. There also might be an age or time restriction on the protection.

The survivor benefit is commonly smaller sized, and coverage typically lasts up until your kid transforms 18 or 25. This cyclist might be a more cost-effective way to help guarantee your children are covered as motorcyclists can typically cover multiple dependents simultaneously. As soon as your child ages out of this insurance coverage, it may be feasible to transform the biker into a brand-new policy.

The most usual kind of irreversible life insurance coverage is entire life insurance coverage, but it has some crucial differences contrasted to degree term coverage. Here's a standard overview of what to consider when comparing term vs.

The Ultimate Guide: What is Joint Term Life Insurance?

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodParticular The costs for term life insurance are commonly reduced than entire life coverage.

One of the highlights of degree term protection is that your premiums and your survivor benefit do not transform. With decreasing term life insurance coverage, your premiums continue to be the very same; nonetheless, the death benefit quantity gets smaller sized in time. For instance, you might have insurance coverage that begins with a survivor benefit of $10,000, which might cover a home mortgage, and after that annually, the death advantage will certainly decrease by a set amount or percentage.

As a result of this, it's typically an extra budget friendly type of degree term insurance coverage. You may have life insurance policy with your company, however it might not suffice life insurance policy for your requirements. The very first step when purchasing a plan is establishing just how much life insurance policy you require. Consider factors such as: Age Family members dimension and ages Work status Income Debt Way of living Expected last expenditures A life insurance policy calculator can aid establish just how much you need to start.

The Basics: What is Direct Term Life Insurance Meaning?

After making a decision on a plan, complete the application. If you're authorized, authorize the documents and pay your initial premium.

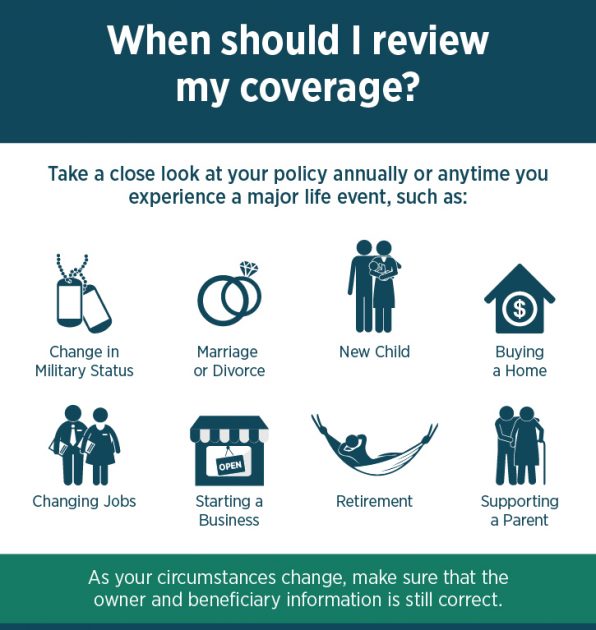

Take into consideration scheduling time each year to review your plan. You might wish to upgrade your recipient details if you have actually had any type of considerable life modifications, such as a marital relationship, birth or separation. Life insurance policy can in some cases feel challenging. You do not have to go it alone. As you explore your alternatives, take into consideration reviewing your needs, desires and worries with an economic expert.

No, level term life insurance does not have cash worth. Some life insurance policy policies have an investment feature that enables you to construct cash worth gradually. A portion of your premium settlements is reserved and can earn rate of interest gradually, which grows tax-deferred during the life of your insurance coverage.

These policies are usually considerably extra pricey than term coverage. If you get to completion of your policy and are still active, the protection ends. Nevertheless, you have some choices if you still want some life insurance coverage. You can: If you're 65 and your insurance coverage has actually run out, for instance, you may want to acquire a new 10-year degree term life insurance coverage plan.

How Does 20-year Level Term Life Insurance Work?

You may have the ability to convert your term protection into a whole life policy that will certainly last for the remainder of your life. Numerous sorts of degree term policies are convertible. That suggests, at the end of your insurance coverage, you can convert some or every one of your plan to whole life protection.

A level premium term life insurance plan allows you stay with your budget while you assist secure your family members. Unlike some tipped price strategies that boosts every year with your age, this type of term plan uses rates that stay the exact same for the duration you pick, even as you obtain older or your wellness modifications.

Discover more about the Life Insurance coverage alternatives available to you as an AICPA member (20-year level term life insurance). ___ Aon Insurance Providers is the brand for the brokerage and program management procedures of Affinity Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Coverage Firm, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Fondness Insurance Coverage Services, Inc .

Table of Contents

Latest Posts

Sell Final Expense Insurance

Final Expense Program

Cremation Insurance

More

Latest Posts

Sell Final Expense Insurance

Final Expense Program

Cremation Insurance